wisconsin used car sales tax calculator

Wisconsin has a 5 statewide sales. 425 Motor Vehicle Document Fee.

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Scroll down to Sales Taxes when using Fee Calculator.

. Some counties also charge a stadium tax of 01 percent notes the Wisconsin Department of Revenue. The information provided generally relates to the states 5 sales and use tax. Multiply the net price of your vehicle by the sales tax percentage.

Every state has a different way of calculating the fees for used cars. Multiply the net price of your vehicle by the sales tax percentage. Individual costs will vary based on conditions and driving habits.

Then use this number in the multiplication process. Wisconsin WI Sales Tax Rates by City The state sales tax rate in Wisconsin is 5000. This calculator can help you estimate the taxes required when purchasing a new or used vehicle.

16450 for an original title or title transfer. Amount before taxesSales tax rates Meat Packers German restaurants and dairy farmers are just a few of the almost half a million small businesses that hire more than a million employees in Wisconsin. To do that there are four drop-down menus at the top of the tool please use the following order when selecting a vehicle to compare.

The county the vehicle is registered in. Tax Calculators Finance Calculators Car Finance Calculators Mortgage Calculators Math Calculators Physics Calculators Chemistry Calculators Human Resource Calculators Engineering Calculators Health Calculators Sports Calculators Logistics Calculators Popular Today. Vehicle use taxMCTD fees NYC and some counties North Carolina.

The Wisconsin state sales tax rate is 5 and the average WI sales tax after local surtaxes is 543. Please note that special sales tax laws max exist for the sale of cars and vehicles services or other types of transaction. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Wisconsin local counties cities and special taxation districts.

Vehicles are exempt from the 1 Atlanta tax add. Posted on February 8 2021 by. Midwest Driver Fee Calculator User Instructions The first step is selecting a vehicle to compare.

USA Tax Calculator 2020. Wisconsin car sales tax calculator. 227145 How are car loans in Wisconsin calculated.

Wisconsin residents must pay a 5 percent sales tax on car purchases plus county taxes of up to 05 percent. WisDOT Office of Public Affairs 608 266-3581 opaexecdotwigov. In addition there may be county taxes of up to 05 along with a stadium tax of up to 01.

With local taxes the total sales tax rate is between 5000 and 5500. Annual Tax Calculator. The exact tax rate may vary for your location.

Some dealerships also have the option to charge a dealer service fee of 99 dollars. See the table at the bottom for detailed information. Wisconsin Car Sales Tax Calculator.

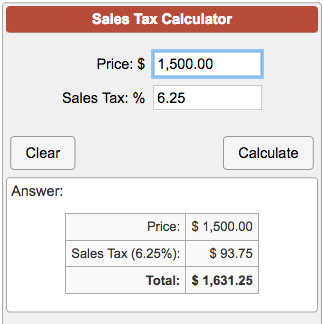

66 Title Ad Valorem Tax TAVT Calculator. Free calculator to find the sales tax amountrate before tax price and after-tax price. Remember to convert the sales tax percentage to decimal format.

Select Vehicle Type from the first drop-down Select Vehicle Make from the second drop-down. Vehicle Property Tax based on value and locality. Wisconsin Sales Tax The statewide sales tax in Wisconsin is 5.

While tax rates vary by location the auto sales tax rate typically ranges anywhere from two to six percent. However if a vehicle purchased in another state the District of Columbia or the Commonwealth of Puerto Rico is subject to sales tax in that jurisdiction a credit against Wisconsin sales or use tax due is allowed for sales tax paid to that jurisdiction up to the amount of Wisconsin tax due sec. Divide tax percentage by 100 to get tax rate as a decimal.

State Car Tax Rate Tools. The exemption may be. While the calculator contains a number of models and years it is not yet comprehensive.

Title Fees Title fees for a standard automobile in Wisconsin cost 16450 for the original title or title transfer. Find list price and tax percentage. The state use tax rate is 5 and if the item purchased is used stored or consumed in a county that imposes county tax you.

Select the Wisconsin city from the list of popular cities below to see its current sales tax rate. For example if your state sales tax rate is 4 you would multiply your net purchase price by 004. There are also county taxes of up to 05 and a stadium tax of up to 01.

Texas Salary Comparison Calculator 2022. Highway use tax of 3 of vehicle value max. If you have tax rate as a percentage divide that number by 100 to get tax rate as a decimal.

New car sales tax OR used car sales tax. The total tax rate also depends on your county and local taxes which can be as high as 675. Wisconsin car sales tax calculator Home.

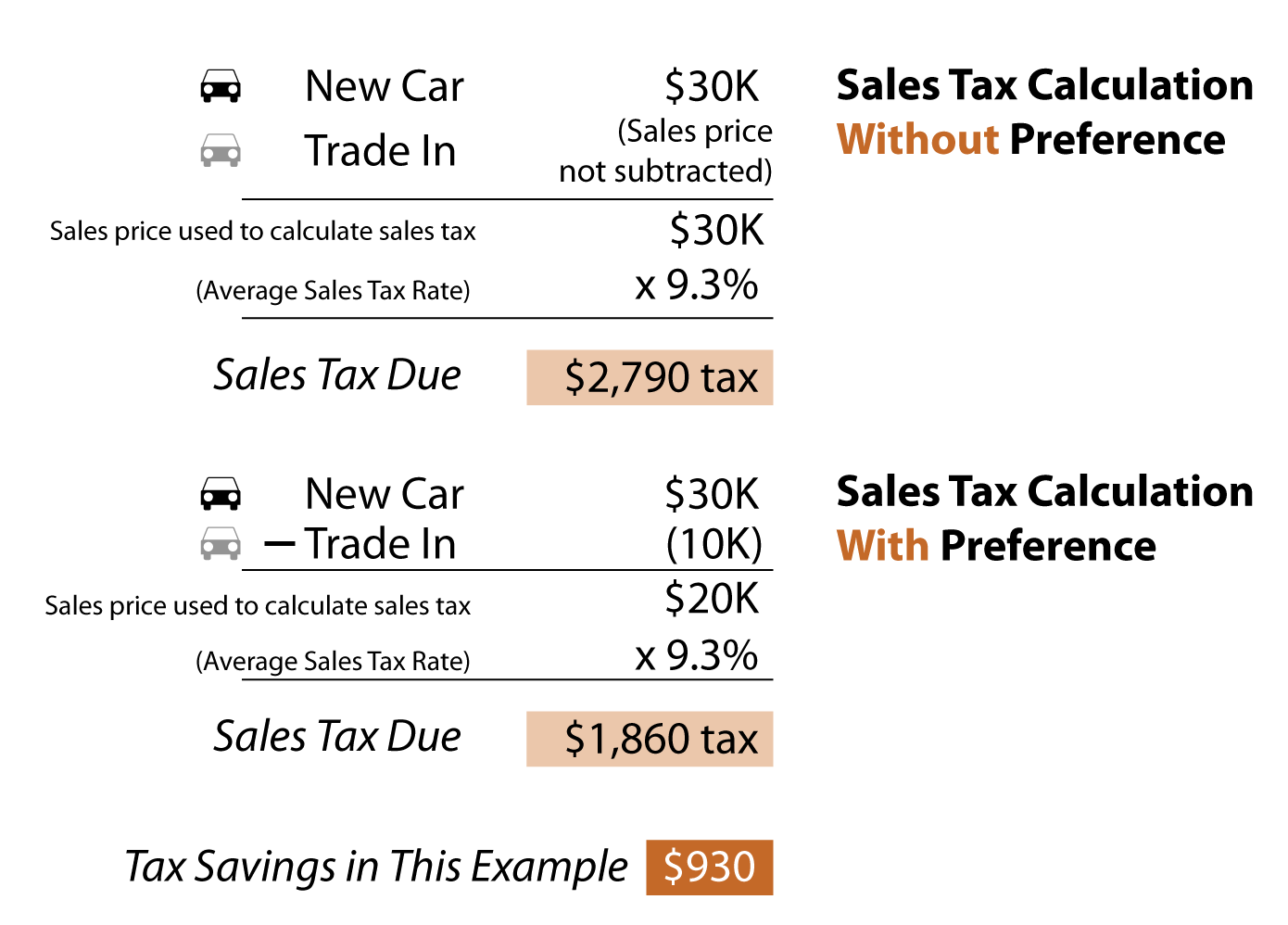

250 for new 1640 for some vehiclescounties. Therefore car buyers get a tax break for trade-in vehicles in Wisconsin. Wisconsin includes extended warranties and doc fees in the taxable amount of an auto loan but does not include the trade-in value.

For more information contact. 41666 maximum visible pass on rate Maui County 44386 Hawaii County 47120 for Honolulu and Kauai County Oahu Island Excise vs Sales Tax. Wisconsin Sales Tax Calculator calculates the sales.

Anytime you are shopping around for a new vehicle and are beginning to make a budget its important to factor in state taxes titling and registration fees vehicle inspectionsmog test costs and car insurance into your total cost. If you properly paid sales tax in another state the sales tax paid may be used to offset the Wisconsin use tax due. The date that you.

However in counties which have adopted the 05 county sales and use tax and counties where the 01 or 05 stadium tax is imposed the coun-ty tax and stadium tax may also apply to any transaction which is subject to the state tax. Motorists can find the Midwest Driver Fee Calculator on the WisDOT website. Multiply the price of your item or service by the tax rate.

How to Calculate Sales Tax. Wisconsin Used Car Sales Tax Calculator. Regional transportation tax in some counties.

Wisconsin has recent rate changes Wed Apr 01 2020. Wisconsin collects a 5 state sales tax rate on the purchase of all vehicles. What youll pay depends on the local regulations type of car and whether you buy or lease the vehicle.

Wisconsin car sales tax calculator. The sales tax charged on car purchases in Wisconsin is 5 so you can expect to pay at least 5 of the total vehicle price for the tax fee. For example if your state sales tax rate is 4 you would multiply your net purchase price by 004.

Calculate Sales Tax On Car Clearance 50 Off Www Ingeniovirtual Com

Calculate Sales Tax On Car Clearance 50 Off Www Ingeniovirtual Com

Calculate Sales Tax On Car Clearance 50 Off Www Ingeniovirtual Com

Car Tax By State Usa Manual Car Sales Tax Calculator

Trade In Sales Tax Savings Calculator Find The Best Car Price

Understanding California S Sales Tax

What S The Car Sales Tax In Each State Find The Best Car Price

Wisconsin Sales Tax Small Business Guide Truic

Sales Taxes In The United States Wikiwand

New York Sales Tax Calculator Reverse Sales Dremployee

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

Woocommerce Sales Tax In The Us How To Automate Calculations

States With Highest And Lowest Sales Tax Rates

Sales Tax By State Is Saas Taxable Taxjar

How To Calculate Sales Tax For Vermont Title Loophole Cartitles Com